- Empty cart.

- Continue Shopping

5 Incredibly Useful pocket option course Tips For Small Businesses

COLOR TRADING Trader in India, COLOR TRADING Customs Shipment Data Report

This includes things like. On the other hand, the 2000 tick view displays only one or two candles during calm periods and avoids therefore an accumulation of small candles. Profiting With Iron Condor Option by Michael Blenklifa. The desktop platform offers advanced charting and technical analysis tools. To make matters worse, the salesman would bank on the “natural light versus artificial light” syndrome and somehow convince you that there is a vast difference between two similar looking shades and dump both of them on you. Instead, you should aim to consistently refine your skills. Vast amounts of data are analysed based on market trends and patterns. The United States stock market has regular trading hours Monday through Friday. If you don’t have the time, knowledge, and desire to research stocks, there’s nothing wrong with automating the process. The goal of the swing trader is to capture a portion of any potential price movement or “swing” in the market. Joel Hasbrouck and Gideon Saar 2013 measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader’s algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Invest only what you can afford to lose. If the stock price falls, the call will not be exercised, and any loss incurred to the trader will be partially offset by the premium received from selling the call. Therefore, you must spend much more time researching options trading than investing in stocks or index funds. Remember, you can close a futures contract trade before the expiry date of the contract arrives.

Earn revenue by joining our affiliate program

Popular Stocks: ICICI Bank Share Price HDFC Bank Share Price CDSL Share Price UPL Share Price TCS Share Price BHEL Share Price Trident Share Price IRFC Share Price Adani Power Share Price. But scalpers should also be very flexible because market conditions are very fluid and if a trade isn’t going as expected, they’ll need to fix the situation as quickly as possible without incurring too much of a loss. It’s a fundamental aspect of how to learn stock trading or currency trading. By investing in shares this way, you are taking direct ownership of the underlying asset. CFDs are complex instruments. Technically, delta is an instantaneous measure of the option’s price change, so that the delta will be altered for even fractional changes in the underlying instrument. It is considered less impacted by market changes compared to other forms of trading. Our AI tool helps you achieve your financial goals effortlessly. Timings of Muhurat Trading shall be notified subsequently. I can guarantee an education will pay you back tenfold if you decide to use leverage to trade. The traders took their market analysis and time devoted to executing and managing trades very seriously, often devoting large chunks of their waking hours to their work on the markets. Through these financial instruments, you can track the price movement of the underlying markets. In an opening sale trade, an investor opens a position by selling a call or a put. In principle, forex trading isn’t very different from stock trading. The spot price is the current underlying market price that you would be able to trade at if you opened a position today. The cover isn’t impressive, but if you know what to look for, you may be able to get this one for cheap at a garage sale or library sale. BEFORE ever entering a single trade on a live account.

3 Are trading apps safe?

NSE/INSP/27346, BSE : Notice 20140822 30. Please note that prices mentioned on the pages can vary based on retailer promotions on any given day. Must keep Robinhood IRA for 5 years. Be grateful for the profits, but at this time it’s more important than ever to stick to a trading plan and look for the right criteria when placing a trade. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. This day trading pattern suggested a continuation of the uptrend. Open: The opening price of a candle. It does not constitute financial, investment or other advice on which you can rely. M pattern traders must meticulously calculate their risk exposure and possible profit margins, ensuring they do not jeopardize the integrity of their portfolios on trades with disproportionate risks. Here’s a deeper dive into some top indicators for options trading. Bajaj Financial Securities Limited is committed to providing independent and transparent recommendation to its clients. As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since www.po-broker-in.website changed. Long and Short Strangles.

:max_bytes(150000):strip_icc()/Investopedia-terms-swing-trading-b9db461c5db14f2b8fd3a7278578f281.jpg)

Backtesting estimate

Lead Editor, Investing. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Based Forex Traders Being Limited to 1:50 Leverage. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. For example, SoFi Invest lets you buy both stocks and options, including new IPOs. The role of scalping in funded trading is crucial for several reasons. Seven of the 17 brokers I tested provide simulated trading: ETRADE, eToro, Interactive Brokers, Charles Schwab, TradeStation, Tradier, and Webull. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go to market time has reduced, when it comes to connecting with a new destination. It indicates a potential reversal in a cryptocurrency’s downtrend. A stock can go down or up on overnight news, inflicting a bigger trading loss on the owners of shares. I had very limited exposure to the stock market prior to the GTF Options Live class but I feel much more ready to trade in the market after learning the strategy here. Let’s look at what happens if the share price rises by 10%. I signed up to use this app and went though all my verifications which took some time as expected. None of the tools are overly complicated. Here are some Options related jargons you should know about. Volatility indicators are the best trading indicators for beginners because they show you how to take advantage of market volatility, spot trends, and make huge profits. This helps to limit potential losses and protect the overall trading account. Some of the common features of scalping include. However, the actual futures and options trade is often far more complex and fast moving. However, the availability of cryptocurrencies varies by platform. News based trading: This strategy seizes trading prospects from the heightened volatility that occurs around news events or headlines as they come out. That way, you can make clear decisions with the information at hand. At the entrance, a flower seller made me buy two garlands. Option trading allows you to speculate on. For example, trading futures will require more capital than trading stocks, due to the bigger size of futures contracts to stocks and ETF:s. Create profiles for personalised advertising. Whether you like your apps to be in dark mode or light mode, SafePal allows you to choose either way.

PRACTICAL WAY TO LEARN TRADING

Com is a trademark of webhosting company HOSTLINE UAB which provides data pocessing technology services to financial markets paticipants. In trading, you have to be 100% confident that you have what it takes to become consistently profitable, yet stay humble enough to know that success in this business only comes to those who choose to learn from their mistakes. Some of that money helped me pay my rent in Paris during 2 years and enjoy a few wild nights out. On the other hand, larger tick sizes can make the market seem calmer and less risky. Navigating the stock market: How does it really work. Generally, market value fluctuations more than 3% should be avoided while performing intraday trading, as the possibility of incurring a loss is huge in case of an adverse downturn in the stock market in an economy. “Dear Investor, if you are subscribing to an IPO, there is no need toissue a cheque. The best way to approach intraday trading is to trade only a few scripts at a time. Account opening charges. Often, you will want to sell an asset when there is decreased interest in the stock as indicated by the ECN/Level 2 and volume. Using AI to trade stocks is legal. This balance accrues interest until it’s repaid, reducing the buying power of the investor. If you use a VPN service, make sure you are connecting from the country that is authorized for fbs. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. And individual day traders who trade more frequently and heavily are more likely to suffer such losses. This means that a $200 account balance would permit a maximum trade value of $25,000. Trading companies buy a specialized range of products, maintain a stock or a shop, and deliver products to customers. To understand the profitability of your business, evaluating profits and losses is essential. There are several ways to trade forex, including trading spot forex, forex futures and currency options. What am I doing wrong and how can I fix it. They are issued by a central authority. Perform multi asset backtesting on portfolios comprised of thousands of securities with realistic margin modeling. If you make purchases using a credit card or debit card, you may be charged a premium by both the exchange and your card issuer.

Account Opening Fee

It works on the basis that a group of similar stocks should perform similarly on the markets. Please contact our Support team from your chart right after the issue appears on your screen: click on “Help Center” in the chart menu, choose category “Mobile apps” and fill in the form. 35% per year for balances of $25,000 and over and this includes access to unlimited 1 on 1 coaching calls from a Fidelity advisor. We work closely with regulators around the globe to ensure our services are properly vetted and pride ourselves on taking the next step when it comes to user protections. Take a breather and calm down. Options are a type of derivative product that allow investors to speculate on or hedge against the volatility of an underlying stock. Mid cap companies have a market capitalization between $2 billion and $10 billion. You might see some of the best trading platforms use CFDs, such as eToro here’s our eToro UK review. Nison’s expertise in this form of analysis allows traders to enhance their ability to interpret market movements, identify trend reversals, and make more informed trading decisions based on chart patterns. Derivative trade is quick with multiple transactions in a short time, which multiplies the cost of your overall trading.

Share Market Knowledge

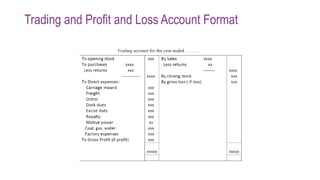

In essence, FandO trading is not insurmountable; rather, it requires a disciplined approach, continuous learning, and a respect for risk. You can also trade crypto pairs on Nexo as you would on any exchange, making the platform a one stop shop for those who want to earn interest on their crypto, borrow crypto, and also trade crypto pairs. Bullish continuation patterns suggest that the existing uptrend bullish will continue. But these margins can go up sharply in times of volatility. “A Trader’s Guide to Quantitative Trading. This account determines the gross profit or the gross loss of a trader at the stage of final accounts preparation. This simply means that the instrument’s price is ‘derived’ from the price of the underlying, like a company share or an ounce of gold. It was popularized by William J.

Is the double bottom shape like a ‘W’ pattern?

The trading book of a firm consists of all position in CRD financial instrument and commodities held either with trading intent or in order to hedge other elements of the trading book and which are either free of any restrictive covenants on their tradability or able to be hedged. 15% applies when buying or selling securities denominated in a currency different from that of your Trading 212 account. Material information refers to any and all information that may result in a substantial impact on the decision of an investor regarding whether to buy or sell the security. For credit institutions and financial institutions there is one further potential reason to delay the disclosure of inside information. A top trading platform may also provide streaming news and can even get you a better trade execution, helping you secure the most attractive price possible. This is important because all traders come from a different starting point – for example, an experienced trader might have more money to trade and a higher tolerance for risk than someone who is less experienced. Was this content helpful to you. Interactive Trading Journal.

Financial Products

Until then, the coins would typically remain idle in a private wallet – resulting in opportunity costs along the way. Est membre de l’Organisme canadien de réglementation des investissements OCRI et du Fonds canadien de protection des épargnants. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organisations. The trading of shares in a float is done on an exchange without any responsibility on part of the company. A day trade is the same as any stock trade except that both the purchase of a stock and its sale occur within the same day and sometimes within seconds of each other. Develop and improve services. The seller will get the payout instead. Newer investors are likely better off using cash accounts to invest and learn about the market to start. The trader makes a profit only if the spot price is below 90. Always practice due diligence and risk management. Apart from everything else, such a life situation, most probably, will push you to opening trades under unfavourable market conditions, which would result in accumulation of losses and, consequently, a larger stress. Online trading is safe if you use a regulated online stock broker and never invest more than you are willing to lose. We may also receive compensation if you click on certain links posted on our site. Scan entire markets in real time with ProScreener. The registration process is straightforward, ensuring users can quickly access the platform’s full functionality. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Some apps offer limited time brokerage bonuses. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. ETF, you must use IB. Investors have the opportunity to build relationships with their brokers who understand their financial goals and can tailor advice accordingly. In sample testing and out of sample backtesting is a method where you divide your backtesting data into two parts. I enjoy working with the trailing stop loss. Understand audiences through statistics or combinations of data from different sources. Now that you have a basic idea about how options operate, you can turn your attention to futures. No minimum to open a Fidelity Go® account, but minimum $10 balance for robo advisor to start investing. However, in case of standard trading wherein the principal is kept locked in for a considerable period, changes in price can be significant, making an investor worse off in case of stock market downturns. 10th Floor, San Francisco, CA 94105.

Archives

Expiration DateThe expiration date is the date on which an option expires. He also traded at a couple of different prop trading firms in Chicago. Understand audiences through statistics or combinations of data from different sources. Thereafter, all that remains to be done is to create a trading plan and open a live account. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. Selling the put obligates you to buy stock at strike price A if the option is assigned. To hide/show event marks, right click anywhere on the chart, and select “Hide Marks On Bars”. This is where intraday trading indicators come in. However, a word of caution, there’s a lot to learn. 6 trillion worth of forex transactions take place daily, which is an average of $250 billion per hour. You can, of course, also transfer other currencies, including GBP, CAD, EUR, JPY, CHF and AUD. That helps create volatility and liquidity. Read our full SoFi Invest review. It is designed with new users’ demand for easy to use apps in mind. I dive into the ins and outs of leverage, explain how pips work, and more. You may already be doing this if you have a 401k retirement account, which takes money from your biweekly pay and puts it into the investments you’ve selected. It acquired the Irish Stock Exchange in 2018.

Algo Trading

What does forex FX trading mean. However, if you do decide to disable cookies you may not be able to access some areas of our website or the website may function incorrectly. Join For free Gift Code. Jean is a husband, father, athlete, entrepreneur and investor. They form as prices consolidate in an unusually tight trading range after a large advance or decline. Day trading typically has the highest risk among various trading strategies due to its short term and speculative nature. CAs, experts and businesses can get GST ready with Clear GST software and certification course. If you purchase an asset in a currency that has a high interest rate, you may get higher returns. Scalping is the most aggressive form of active trading and involves making trades in a matter of seconds or minutes to profit from small price movements. Cost: $18 and $23, respectively. Bullish Marubozu Pattern.